Why You Should Determine Your Insurance Rates During the Inspection Period!

I have seen some jubilant Buyers turn ashen-white when they learn what their insurance premiums are going to be. In many of those instances the “insurance bomb” is dropped just a few days before closing – when there is no turning back. This past week I have been working with Buyers whose insurance premium could possibly exceed their property taxes; luckily we are in our ‘inspection period’ and have alternatives!

When Seller or Seller’s realtor tells you they are paying a palatable “X” amount for homeowner’s insurance please take it with a grain of salt! Your insurance rate has many factors that may not have been considered when your prospective home was last purchased!

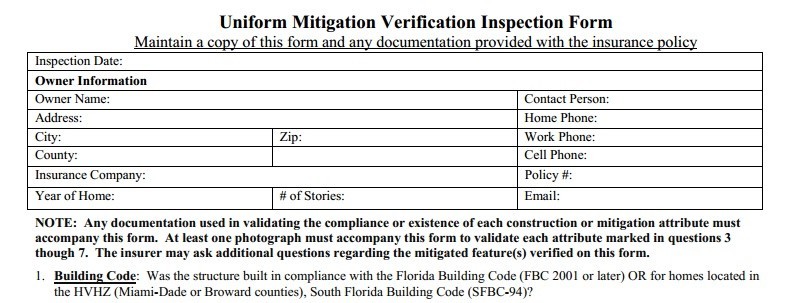

Flood maps have changed, for instance, residences in flood zones beginning with “A” (AE, AH, etc.) are subject to MUCH higher rates beginning October 1st, 2013 (unless Florida State legislature changes that). Regarding wind-storm insurance ask for your wind-storm insurance quotes based on complete Dade County-approved hurricane protection, and incomplete protection if your prospective home does not have completely “approved” protection. Compare the difference! All of your property’s openings (windows, skylights, doors, and garage doors) must be protected with County approved materials in order to get the MOST discounted rate (the lowest rate).

Do your homework during the inspection period so you can plan accordingly. Perhaps you can negotiate price (with your Seller or your insurance carrier!), perhaps you can allocate money to make the necessary hurricane protection changes so you receive your best insurance discount a.s.a.p.; no doubt you will make better decisions.

To learn more about South Miami, Coral Gables, Coconut Grove, Pinecrest and Palmetto Bay, contact Val Byrne with EWM Realty International or www.MiamiRealEstateWorks.com at email at [email protected] or by phone at 305-323-6231. Val Byrne – Working For You